(866) 600-8762

What Is A Construction Mortgage?

A construction mortgage allows you to draw down on the full amount of the mortgage at predetermined stages of the home construction (these are called Draws), from shovels in the ground to moving in. If you already own the land you want to build on, a first advance is available as equity take-out. If you have not yet bought the land, a first advance is available to assist you with the purchase of a vacant lot or home to be torn down/built upon

Building your new home takes stages from start to finish including different types of financing. Depending on your end goal as well as financial situation this will be a mixture of Alternative, construction & institutional lending. While building a house can be a creative and exciting experience, it also comes with complicated financial choices which is why our Mortgages Agents are positioned to educate you on the pros & cons of all solutions while offering the most cost effective, efficient solution

Citadel Mortgages Mortgage Agents have an in-depth knowledge of construction mortgages, we can give you the support you need from start & are with you throughout the process as well as after the finish to guide you through the process and explain all the important facts you need to know

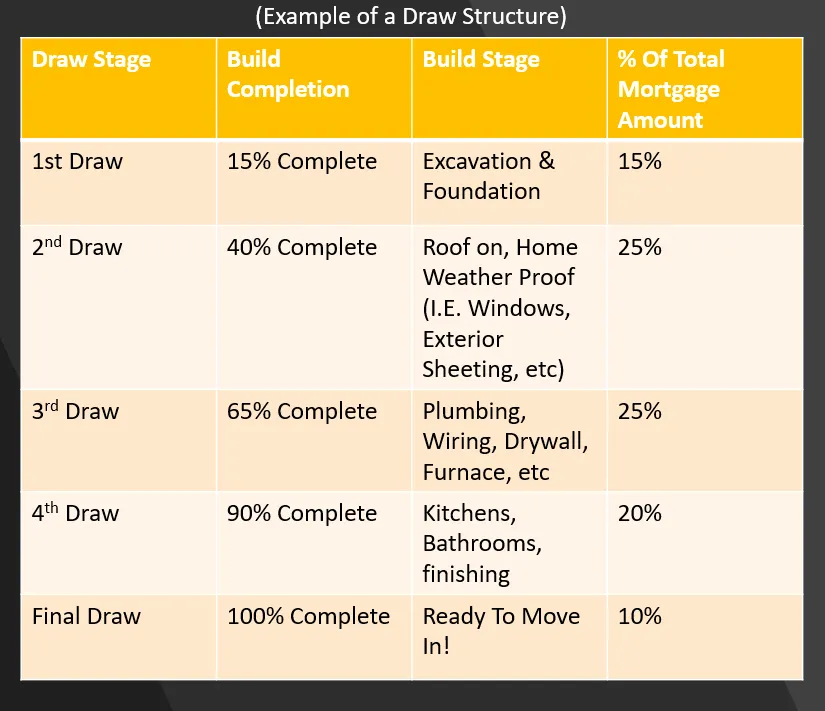

What Is A Draw Structure?

What is a Draw Structure? Construction mortgages are given on a progress advance basis. The full amount that you need to borrow, in order to complete your construction, is given to you in Draws as you complete various phases of completion. - You will need to have sufficient funds to cover the Soft Costs (see next page) & the 1st Phase of Construction (See Example Draw Chart to the Right) before your 1st Construction Draw is advanced Note: Prior to each Draw being advanced an approved Appraiser will visit the property to conduct a progress report for the Lender. The Lender will advance funds based on the percentage complete at time of the progress report. Costs associated with draws fall on the Borrower (You)

Stages Of Financing

1. Buy or Refinance Land

(Alternative Financing)

You’re Purchasing or currently own the land

- If purchasing finding a suitable property would be the first step once you’ve spoken to a Citadel Mortgages Mortgage Agent

- If you own the land, then getting started with planning and soft costs would be the first step after consulting a citadel Mortgages Mortgage Agent

2. Complete Pre-Construction SOFT COSTS (From own capital or from Alternative Refinancing)

Pre-Construction Financing (Soft Costs)

- These are costs associated with everything needed to get to a stage where shovels are in the ground & ready to start building

3. Construction of Home to 100% Complete (Alternative Financing, Construction Mortgage)

Construction Financing (Hard Costs)

- Construction Financing includes all building required after the completion of the 1st Phase till the Home is 100% complete

4. Refinance to acquire long term solution Financing (Generally A or B Institutional Lending)

Institutional Financing

- Once you are ready to move in our Citadel Mortgages Mortgage Agents will refinance out into the best solution for the long term

5. Move in Ready!

Getting Started

- Make A Budget

- Determine Your Timeframe

- Find the Property For Your Dream Home

What to Consider When Designing Your Home

- Determine the size of your home, how many rooms are needed. There may be restrictions on size

- Decide what you require in your home based on lifestyle

- Choose a layout that works for you

- Figure out your style

- Are there any special features you want? (fireplaces, heated floors, etc)

Put Your Dream Team Together

- Hire An Architect

- Hire A General Contractor

- Monitor The Project & Ensure They Stay On Course!

Our team has access to a suite of proprietary tools and resources that you made need. At Citadel Mortgages we are here to help you throughout the process and beyond

Copyright © 2020 Citadel Mortgages

Head Office – 150 King Street West 2nd Floor Suite 335, Toronto, ON M5H 1J9

Alberta Office – 421 7th Avenue S.W., 30th Floor, Calgary, Alberta, T2P 4K9

Nova Scotia Office – 1701 Hollis Street, Suite 800 Halifax, NS B3J 3M8

Saskatchewan Office – 2010 – 11th Avenue 7th Floor Regina Saskatchewan S4P0J3

Newfoundland Office – 1 Church Hill – Suite 201-522 St. John’s Newfoundland A1C 3Z7

New Brunswick Office – 500 St George Street, Moncton NB, E1C 1Y3

British Columbia Office – 4170 Still Creek Drive Suite 200, Burnaby BC, V5C 6C6

Citadel Mortgages is licensed in the following: Ontario FSRA 12993 – Saskatchewan FCAA 509446, Nova Scotia 212783099 – Alberta, PEI, Nunavut, Newfoundland 21-07-CI083-1. New Brunswick 210031130, British Columbia X301267

All rights reserved

“Instant Approval, Conditional Approval, Pre-Approval” – Borrower subject to credit and underwriting approval. Not all borrowers will be approved for conventional financing or equity financing. Receipt of borrower’s application does not represent an approval for financing or interest rate guarantee. Restrictions may apply, Annual APR is subject to approval and underwriting, APR includes all fees and rate which is calculated on a yearly term. APR varies contact us for current rates or more information on a specific product. OAC*

®™ Trademarks of AM Royalties Limited Partnership used under license by LoyaltyOne, Co. and Citadel Mortgages

Est 2018

Changing The Way Mortgages are Done